With all the discussions about tax rates and the prodigious amount of municipal deficits, our politicians and media tell us that we must increase tax rates to survive. One is left with the hollow feeling that there are no options and we must raise taxes regardless of the effects to stave off bankruptcy. After all, it would seem logical on paper, higher tax rates equal more revenue, but does this correspond to reality?

With all the discussions about tax rates and the prodigious amount of municipal deficits, our politicians and media tell us that we must increase tax rates to survive. One is left with the hollow feeling that there are no options and we must raise taxes regardless of the effects to stave off bankruptcy. After all, it would seem logical on paper, higher tax rates equal more revenue, but does this correspond to reality?

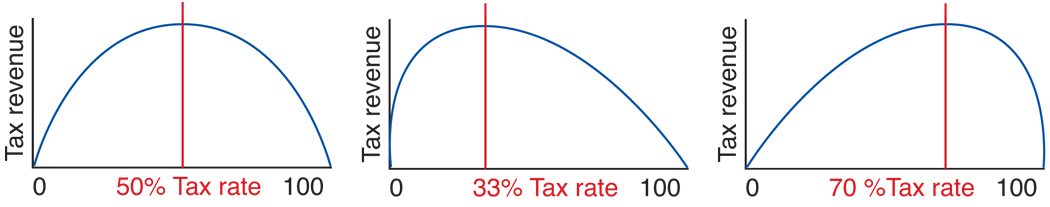

The question to be answered is what tax rate produces the highest amount of revenue? In 1974, Prof. Arthur Laffer demonstrated that taxes can only be raised to a certain level after which revenue decreases. He represented this link with a simple graph that showed the relationship between tax rates and tax revenue; the Laffer curve.

The Laffer curve is based on the obvious fact that people work for compensation, and if tax rates reach 100%, the far right of the curve, this would cause people to choose not to work because the entire fruit of their labor would go to the government. Essentially, all incentive is crushed by unjust taxation.

This concept is easy to understand and is founded in the virtue of justice and the principle of private property. Property is produced by intellectual and physical labor and if a government confiscates all, or a substantial portion of private property, there is no incentive to work. To understand this more clearly, it is only necessary to see the results caused by the errors of Communism, which abolishes private property, and look to Russia, China, Cuba and North Korea’s economic failures.

Learn All About the Prophecies of Our Lady of Good Success About Our Times

For many decades, university courses in economics had taught that the optimum tax rate was in the vicinity of 70%. Obviously zero and one hundred percent taxes will produce no revenue. There is now evidence that suggests that the maximum tax rate is around 33%.

One comprehensive study has been done by none other than Obama administration Chair of Council of Economic Advisers (CEA), Christina Romer and her husband David. They did an excellent analysis of revenue generated from various tax rates and their work is titled The Macrcoeconomic Effects of Tax Change. This was published in the American Economic Review during Christina’s tenure at the White House. The Romer’s examined the effects of tax policy on GDP and found the impact to be very substantial.

In their work they state that “In short, tax increases appear to have a very large, sustained, and highly significant negative impact on output…. The behavior of output following these more exogenous changes indicates that tax increases are highly contractionary. The effects are strongly significant, highly robust, and much larger than those obtained using broader measures of tax changes.”1

While there is no shortage of critics of the Laffer curve or the Romer study, as there are many factors that influence income and debt, one cannot deny that Laffer and Romer address the fundamental element of incentive. If a political system punishes initiative and rewards indolence, it produces misery.

With such a quantity of evidence demonstrating that raising taxes smothers an economy, one is left asking what could be the intention of those who are insisting upon raising them? It appears that raising them inordinately will only stifle an economy, not fix a fiscal crisis.

Many countries in Europe have set a stinging example of what not to do, such as the 75% tax on higher incomes passed in socialist France. There are many ways to reduce debt. However austerity coupled with a fair, not an overbearing graduated income tax, is the only tried and proven method. In short, socialistic tax policies only serve to penalize initiative, not reward it. At the same time, they reward the indigent, lazy and incompetent.